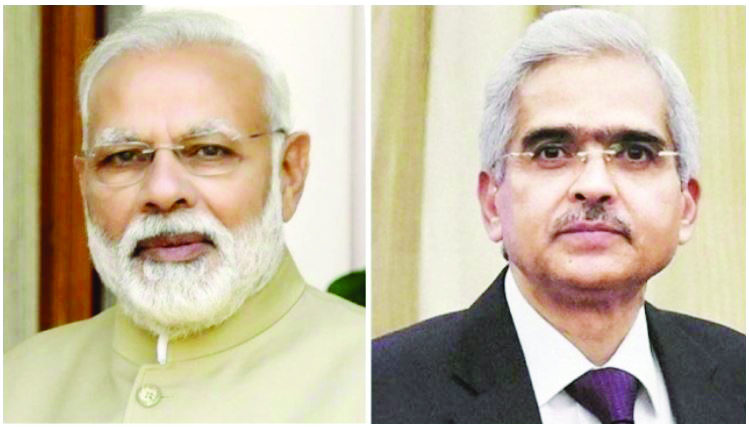

AUTONOMOUS OR PUPPET? The question everyone is asking after RBI governor Urjit Patel resigned, is whether his replacement, new RBI Governor Shaktikanta Das (right) will be PM Modi’s cash cow for the 2019 General Elections. Critics say Modi is hoping to utilise a substantial part of the RBI’s reserves for some generous sops in an election year to save his fast-dissipating credibility

BY RAJAN NARAYAN

Shockingly the RBI which was responsible for the integrity of the banks and the safety of your deposits has issued a statement to the effect that “Deposits are not guaranteed by the RBI or any other agencies”. Which means if big chors like the Nirav Modis and Vijay Mallya steal all the money there is nothing you can do!

Those who have no money have no choice but to spend it on basic necessities like roti, kapda and makan. Roti and kapda are relatively cheaper, but for Goans and bhailes alike, makan can be very expensive.

In the good old days, particularly in villages, a barter system was prevalent. When there was a surplus, people would exchange the excess for goods they needed. If you wanted tomatoes or potatoes, perhaps you could get them in exchange for agricultural implements. Or if you wanted chicken you could exchange it for onion and garlic.

RISE OF BANKING

As communities became larger and larger, and jobs got more specialised, the barter system could not keep up and the first banks came up. People used to keep their extra money (and still do) in banks. Banks do not actually store all the money that depositors have kept in them. In fact, on an average, a bank keep less than 25% of deposits made with them. They lend out a larger portion of the deposits to borrowers, who in turn pay interest on the borrowed amount. To attract money from depositors the bank offers some interest, although this is much less than the interest the bank earns, so as to earn a profit.

As recently as two to three years ago, the interest offered on fixed deposits by some banks was as high as 15%. This was the ideal investment for those looking for a pension after retirement. Unfortunately, interest rates have crashed to around 7%, which is less than half of what we used to receive a few years ago. Why have banks reduced interest rates?

CRASHING RATES

It is logical to presume that you can offer high interest rates only if your earnings are correspondingly high. Banks have been lending out money very liberally to big sharks. Prudent banks only lend money against adequate security. What adequate security means is that they are confident they can recover the money from assets (such as land, buildings or machinery) offered as surety.

Except in Goa there have been problems accepting land as security against loans. This is because Goa is governed by the Uniform Civil Code. Under this code everyone in the family — sons, daughters, brothers, brothers–in-law, sisters-in-law, et al, have a right to the property. If a careless bank manager has not checked the Inventario (the procedure for assessing and dividing all assets amongst the heirs) while acquiring the land as security, there is a risk that some other member of the family may claim that his consent was not taken, which means that even if the person who take the loan defaults, the bank will not be able to acquire the property and sell it to recover its dues.

Unfortunately, due to massive corruption in banks, money has been lent with less or no sureties, purely on the assurances of the big sharks, as in the case of the king of good times, Vijay Mallya, and Nirav Modi, who cheated the Punjab National Bank of `11,900 crore.

There are many more bank robbers, but ironically the biggest of them all is a company supported by the government. IL&FC, which is an infrastructure company in which LIC has the major share, owes over `99,000 lakh crore.

NPAS

It is because of these huge non-performing assets that the majority of public sector banks and even private sector banks have made huge losses. This means that they have taken your money and my money and lent it to rouges and rascals who have used it not to set up industry to generate income, but to buy houses and luxury cars for themselves.

In the recent past, many managing directors of both public and private sector banks have been sacked. There is no limit to greed. While one can perhaps understand public sector bank chiefs stealing money, as they get lower salaries relatively, heads of private sector banks like Chandra Kochar who earn `20 crore a month have no business betraying depositors.

At least in the case of scheduled banks there is a chaukidar (watchman) in the form of the RBI. It is the responsibility of the RBI to monitor the performance of the banks.

All scheduled banks, which include private sector banks, have to keep a percentage of their deposits with the RBI as surety. When banks are in trouble and need money they can borrow money from RBI. The rate of interest at which the RBI lends to other banks is the basis for interest rates charged to borrowers and given to depositors.

The RBI also looks at the inflation rate to decide whether it should lower or increase the prime lending rate. The RBI also has huge reserves which it refuses to part with so that it can help if there is an emergency. In the old days the amount of reserves in gold had to be equivalent to the amount of money lent. Which is why banks carry the promise “I promise to pay the Bearer the sum of x in the note”. But all this means is that if you give them a `100 note they will give you another 100 rupees.

MONEY LOSING VALUE

Even the value of the `100 note has declined to `20. People talk about the time when they could buy land for `10 per mtr and 10 kgs of rice for `5. \

When I first started earning I used to get `400 a month. After six years of working I got `600. But In those days the prices were also low so you could manage. You may now get `20,000 per month, but it buys less than what `600 used to buy in the ‘60s. The loss in the value of the currency is called inflation. Which is why when inflation is high, the RBI raises the rate to insure that there are less borrowings and vice versa.

GOVT VS RBI

Over the last year of the Modi government there have been huge fights between the RBI and the Finance Ministry. Former RBI governor Raghuram Rajan was against demonetisation and GST.

Due to pressure to quit, Rajan refused a second term in the RBI. The Modi government then appointed Urjit Patel as RBI governor, who they thought would be more co-operative with the government. Unfortunately for the Modi government, Urjit Patel also refused to toe the line blindly and resigned.

The Modi government has now turned to Shaktikanta Das, who first shot into the limelight as the Modi government’s point

man for demonetisation.

The RBI has traditionally been an autonomous body and the government cannot force it to act on a certain policy.

There are three major disputes between the government and the RBI. In the first place the government, which is bankrupt, wants the RBI to transfer 50% of its Reserve to the Finance Ministry so that there will not be a huge budgetary deficit this year. The Modi government also want to help out banks which lost huge sums of money by lending to chors by grabbing funds from RBI. The new governor appointed by the Modi, Urjit Patel, refused to part with the crown jewels or the mangalsutra because he did not trust the Modi government so he was also compelled to resign within eight months.

The second bone of contention is that the government wants the RBI to lower interest rates so that more people will borrow and production can go up. Production of engineering goods particularly is at the all time low, which affect both income and jobs.

The third bone of contention is the governments desire that the RBI relax its lending restrictions on 11 state-run banks. The curbs were imposed because the banks had a low capital base and major bad debt problems.

Historically we have always felt that if there is a bank crisis in India like there was even in the UK and the US, the RBI will help us. There is a legendry story about war time Germany, when inflation was so high that people took bank notes in baskets to buy one cabbage.

DISTURBING TREND?

Which is why we were shocked by an advertisement in the Sunday issue of the Herald ostensibly by the RBI. What will you do if tomorrow your parents or your employers say they have no money and they cannot give you salary or food. Shockingly the RBI has said in the advertisement “Deposits are not guaranteed by RBI or any other agency”. The any other agency obviously referred to, is the government. The ad does not specify that the disclaimer refers only to NBFCs (non-banking finance companies) which are referenced in the ad — which indicates either poor design or a dangerous sign for the future.

It could mean that the currency with you — whether `20 or `2,000 does not have any value. With the government encroaching on the autonomy of the RBI we have to wait and watch and act when required. It was only due to vigilant opposition that the proposed FRDI bill was dropped in August 2018.

The RBI ad also warns that investing in NBFCs is even more dangerous than scheduled banks.

NBFCs are companies like the Sahara group who used to collect small amounts of money from shopkeepers and others. They used to tempt people with large returns. Those who deposited were made agents and got higher commissions. Which is why very often they were called chit funds, getting the name from the old practice of drawing a chit out of a box (containing the names of all subscribers) to decide who got the money.

The Sahara group collected over `35 crore but did not return the money. Instead they used it to build a huge housing complex at Lonavala in Bombay which is the grandfather of Aldeia De Goa.

This has forced the RBI to ban deposits in any NBFCs or chit funds not recognized by the RBI.

Similarly co-operative banks are also dangerous. At present the Mapusa Urban Branch has been banned from lending money and even does not allow withdrawing money of more than `100. This is because the directors of the Mapusa Urban Bank used the money for building houses and buying lavish cars. Most of the chairmen of the co-operative housing society are politicians. Ramakant Khalap is the chairman of the Mapusa Urban bank.

‘If the salt itself losses its flavour wherewith shall it be salted’ queried Gandhi. If the RBI, the head of the financial police, says it is not responsible for any chori by financial institutions, what do citizens do? This is the question all citizens have to ask themselves.

NEW WAVE OF NPAs?

By Ravi Krishnan

The Reserve Bank of India has allowed a one-time restructuring of loans to micro, small and medium industries (MSMEs). It is a retrograde step because RBI had put a stop to restructuring in a bid to clean up bank balance sheets. It could very well trigger the new wave of non-performing assets, especially for public sector banks.

The RBI’s financial stability report (FSR) presents a number of reasons why granting a special dispensation for MSME loans is a bad idea, again, with special emphasis on state-owned banks.

For one, RBI’s analysis of TransUnion CIBIL data shows that a good portion of MSME loans outstanding has a high default risk based on the March 2018 ratings distribution.

Two, the gross non-performing assets (GNPA) ratio for state-owned banks in the MSME sector is 15.2% compared with 5% and 3.9% for shadow banks and private banks respectively. Clearly, state-owned banks have more lax credit standards. This is supported by additional data.

Three, state-owned banks have the highest proportion of loans in the riskiest MSME basket, according to the report. They have 17% of MSME loans in this basket compared to 10% for new private banks and 14% for shadow banks.

Four, the lax underwriting standards are made even clearer by the fact that in this riskiest basket, PSU banks have 62% share in plain or working capital loans while around 16% is asset-backed or retail loans. In sheer contrast, NBFCs have 80% of their riskiest loans in the asset-backed/retail category while new private banks have 62%. The report then goes on to say that, “the issue of frauds in working capital limits in PSBs in general have been highlighted in the previous FSR.”

Five, those state-owned banks under PCA restrictions showed a 166% increase in small (below `5 crore) loans to this segment between FY 2016-17 and FY 2017-18. That’s primarily because the lending curbs kick in at much higher levels of loans. Still, the RBI warns that this “sharp increase may require examination of possible dilution of credit standards further and additions to supervisory strategy for PCA banks.”

We all know that how the previous round of forbearance – essentially extend and pretend all is well – ended. It led to the NPA crisis which banks are still grappling with. A demand for special dispensation for the MSME sector also shows that it is under stress. A one-time restructuring just kicks that can down the road. It will lead to a reversal of the meagre asset quality gains that banks have shown.

Moreover, it will lead to other groupings and lobbies queuing up at the RBI’s and the government’s door asking for relaxations. Indeed, the power sector has been in the queue for a long time.

Yes, MSMEs have a major role to play in jobs creation and have been particularly hard hit by demonetisation and the goods and services tax. But a loan recast is not the answer. Making complex regulations simpler, cutting down the Inspector Raj and improving infrastructure are the long term solutions which the government should consider.

Courtesy: Moneycontrol.in