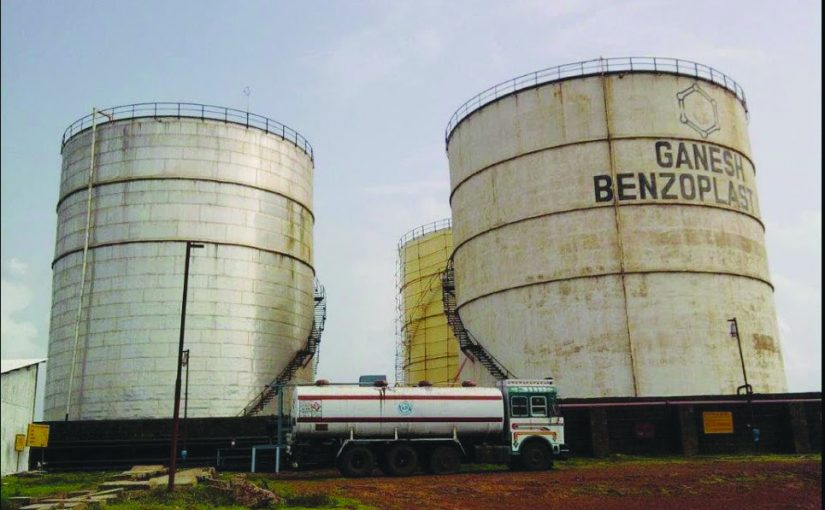

WORSE: The Nalini Saga has become even more dangerous with the Naptha being stored in tanks of a M/s Ganesh Benzoplast Ltd (GBL) located in a very crowded area of Sada.

BY RAJAN NARAYAN

AND A few stray thoughts for yet another Saturday. For a Saturday following the week when I got a message from my nationalized bank informing me that they had dispatched an ATM card by speed post on 12-12-2019. For a Saturday following the week when the General Sales Tax (GST) scheme seems to have collapsed. For a Saturday following the week when the master marinas from Norway refloated the ticking time bomb “Nu Shu Nalini” but the naptha is out and now stored in tanks of M/s Ganesh Benzoplast Ltd (GBL) in very crowded residential areas of Sada in Vasco. For a Saturday following the week when though Goa has been witnessing a series of cultural events there are very few Goans who are participating in them.

And a few stray thoughts on Finance Minister Nirmala Sitaraman wanting to force all Indian bank account holders to switch from Visa to RuPay. Which is the Indian version of the credit card which the Visa and several other banks issue. The logic being that if people use RuPay than the commission which charged each time you use ATM or your Visa debit card will go to the Indian government and not to the United States. No account holder was informed that he had to switch from Visa to RuPay. Even account holders who already have an ATM card from a nationalized bank were sent the message that a new ATM card is being dispatched to them.

This is typical of the Narendra Modi-Amit Shah style of functioning. They give you no choice and you have to obey orders. They did not consult any eminent economist or the Reserve Bank of India or even the Cabinet before announcing demonetization. One evening when we were all watching our favorite serial on television the program was interrupted by an announcement by Narendra Modi. The demonic announcement whereby with immediate effect all 1,000 and500 notes were cancelled. Those who had 1,000 and 500 notes had to get them exchanged for 2,000 notes. This ruined the businesses of small traders who are the backbone of the economy -- as no one had change for2,000. The ostensible objective was to uproot corruption and black marketing. The presumption was that black money was stored in high denomination 500 and1,000 notes. The 500 and1,000 notes which were reduced to scrap papers value could be exchanged at banks but only up to the limit of 25,000. It is alleged that all the top BJP leaders were informed in advance and changed their cancelled notes before demonetization was announced.

Finance Minister Nirmala Sitharaman who seems to be naive of finance is at it again. From January 2020 all the existing2,000 notes will be cancelled and will have no value. After that you can only exchange 2,000 notes with the banks up to a limit of 50,000. Unlike during the demonitisation of 2,000 notes the new cancellation was not even announced widely in papers or other media. So much so most people excepting Sangh Parivar cadres do not know that2,000 notes have been cancelled. The irony is that as per the admission of the RBI when all the cancelled 500 and1,000 notes collected by the banks were counted they found that 99% of the notes were back in the banks. So where did the black money go or with the collusion of banks were the cancelled notes put back in the banks. Which means that without any justification 1.3 crore people of India were put to a great deal of difficulty.

Let us come back to the message I received on December 17, 2019 informing me that an ATM card had been dispatched to me by speed post. My bank is less than one kilometer from our residence. The ATM card which was allegedly sent by Speed Post has still not reached to me. May be they should rename speed post as Tortoise post. I already have a debit-cum-ATM card issued by my bank and had entered into a transaction just ten minutes before I got the message. I rang up my bank and asked them why they had dispatched a new ATM card to me even though I already have one. I insisted that I didn’t want the new ATM card and that it should be immediately cancelled. That I would hold the bank responsible if even one paisa from my account was stolen by whosoever sent the ATM card. Which ironically I still have not received, presuming that someone else was having fun with it.

MANAGER IN DARK

When questioned the bank manager claimed that he himself was unaware of the dispatch of the ATM card. Apparently these cards are posted by the head office of the bank. The head office of the bank must have sub- contracted the task of sending the new ATMs to third parties. However, off the record, the manager reveled that the Finance ministry had decided that Indian nationalized bank should deal with only Indian Credit cards henceforth. Never mind that RuPay is the worst of the credit cards in the market. Surely as a proud, patriotic, independent citizen, I should have the choice to decide which credit card or ATM card I want to use?’

DIGITAL TRANSACTIONS

AND there are those like my better three-quarters who does not trust any digital transactions. Given the fact that connectivity is so bad I am inclined to believe that it is better to rely on you cheque book then your debit, credit or ATM card. Most of the time I cannot even get details of my balance or withdraw money because the server of the bank is not working. All that it takes for the server to go dead is digging by any of the telecom companies or the electricity and PWD departments. They inevitably cut everything including the telecom cables.

To sum up I have not received any ATM card which is supposed to have been sent by speed post from a post office less than a kilometer from my residence and this too six days after it was dispatched. I have written to the RBI complaining about being dispatched an ATM card without my asking for it. I am not a slave but a free citizen and have the right to accept or reject the ATM card as and when I receive it. I have also asked my bank to send me a message immediately if one paisa is withdrawn so that I will know if the ATM card which I have not received is being misused.

AND a few stray thoughts on GST turning out to be a disaster as several leading economists including former prime minister, Manmohan Singh, had predicted. The road to hell is paved with good intentions. The objective of substituting the dozens of taxes levied by the center and the states by a single tax at the point of sale. Before GST there was the sales tax, luxury tax, octroi tax which was an entry tax when goods entered the Municipal area of a city or state. In addition there were dozens of other taxes levied by the center and the states at every point of manufacture. For instance, if you bought a car the manufacturer had to pay taxes on the steel or aluminum used for the body, the tyres that he bought, the mould plastic parts that he bought for the arm rest and the dash board, the electronic part he bought for showing the mileage, etc. All this multiple taxes resulted in increase of the price of the car. Besides it required hundreds of babu or clerks to collect taxes at every point and deposit it into the treasury. Under GST tax would be levied only on the final product regardless of whether it was a car, lipstick, refrigerator or washing machine. In theory of course it sounded very attractive. Instead of paying several taxes the consumer would pay only one tax on finished products. This will not solve the problem of the manufacturer who had to maintain a record of every pin and screw that he bought so that he could get a set off against the expenditure he had incurred on manufacturing the product.

FOR EXAMPLE

TO GIVE you a simple example we as a news weekly have to pay for paper and for printing. There are varying levels of GST such as 12% on printing and 18% on paper. As against this our income comes from advertisements on which there is a 5% GST. I get a set off on my expenditure from my income. Unfortunately, there is no fixed rate of GST. Under public pressure and protests from people and the states, the Finance Minister keeps changing the GST whenever they want without prior information. Clearly the Finance Ministry acted first and thought later. It is like putting the cart before the horse.

Originally, the GST on food and rooms in five-star restaurants which charged more than 8,000 a night was as high as 28%. Which meant that every time you went for a meal at a starred restaurant you had to pay 30% more on the bill to the government of India. Similarly the GST particularly on SUVs was raised to 28%. This had a drastic affect on the auto industry with sales of both four-wheelers and two- wheelers falling by over 200% since GST came into effect. It is only recently that the GST was reduced as the drop in production of cars led to large scale unemployment. This is true of a very wide range of products.

In other countries where they have GST there are only three categories. One is the SIN category which includes cigarettes, cigars and alcohol, which are bad for your health. The second category is basic necessities like rice, wheat, toothpaste, soap, which are of daily use for common citizens. Even in these categories the GST is applied at a very high rate on top quality products like Basmati rice. The third category are items used by the rich and the middle class like luxury cars and Benelli and consumer durables.

Unfortunately the GST introduced by Nirmala Sitharaman dozen of categories. The biggest headache is keeping track of the GST payable and filing the returns. A great deal of time is wasted in filing GST returns by the first week of every month. In addition every quarter the statement has to be updated besides the annual statement. It’s a real nightmare for multiproduct business like supermarkets. If I am selling three dozens different items from soap to vegetables to Christmas turkey, I have to find out the GST rate applicable and file the returns separately. This is fine for big companies. But small traders just do not have the time or the staff to file GST returns. Which is why the expectation that the revenue from GST will be much higher than the total of all the multiple taxes has not been realized. In fact the government of India itself has admitted the short fall against the target is as high as 50%. The worse sufferers are the states which were persuaded not to levy any sales or other taxes and promised their due share of GST collections. Since the center itself is bankrupt how will it reimburse the states. For instance, only recently after a long interval the center gave Goa 200 crores of its share of GST. But the arrears for the last six months has not been cleared. A state like Goa which is already suffering from suspension of mining and drop in tourist traffic just cannot afford delays in getting it shareof GST.

GST COLLECTIONS DOWN

If the GST collections have gone down it is because small traders are having a great time as they are not paying either local state taxes or GST. Indeed, the majority of them have not even registered themselves. How do you catch and punish people who do not exist on the records.

Fortunately for us Finance Minister Nirmala Sitharaman cannot take any decisions on GST herself. There is a committee of chief ministers of which one of the chief ministers by turn is the chairperson. It is the committee which decided if the GST should be increased or decreased. The CM on the committee in turn will want GST on goods employing a lot of workers in their states to be lower.

Like Karnataka would like lower GST on Silk sarees and Surat would like less GST on diamond polishing. The economic slowdown from the peak of almost 15% during Manmohan Singh PMship had come down to less than 5%. This in turn means the number of people unemployed has increased. According to Central government figures the unemployment rate in Goa is 34%. If you are illiterate and have no skills it is easy to get a job. If you are a PHD you can’t even get the job of a sweeper.

STORED IN SADA

AND a last stray thought on the state government jumping from the frying pan into the fire. It took two months for the state governments to find a competent salvager who could refloat “Nu-Shi Nalini”, the crewless ship carrying 3,000 tons of the dangerous chemical naptha. During a stormy day the ticking time bomb broke away from its moorings in the MPT and drifted, getting grounded on the rocks just outside the Raj Bhavan. At least if there was whisky on the ship the governor and the local fisherman could have whisky on the rocks. If they tried that with naptha they would have died a terrible death.

None of the Indian agencies including the DG of shipping, Mormagoa agoa Port Trust, National Institute of Oceanography, Disaster Management Cell could salvage the ship. The Air Force plane in fact dropped the hydraulic pump to be used to pump out the naptha into the sea instead of on the deck of the ship. Finally, the government decided to look for a foreign ship salvaging and rescue company. The marine masters from Netherlands did an excellent job. They started at the bottom as the others should have done. If you want to refloat a leaking ship you have to make sure that there are no holes in the bottom through which water can enter into the engine room. Master Marinas repaired the bottom and refloated “Nu-Shi Nalini” and towed her back to the MPT berth from where she had broken and drifted away. The MPT being the most stupid organization in Goa or perhaps they did not want to take risks decided to pump the naptha to tanks owned by the private party Ganesh Chemicals which had their tanks in the heart of highly populated area in Sada. This would have meant that the naptha would have to be pumped to tankers which would pass through the streets of Goa, endangering the lives of people. So it was decided by virtue court order that the naptha will remain in the tanks till the government finds an international ship into which it can be pumped.

We wish you all a merry Christmas but you have to reconcile yourself to the fact that your turkey will not have onions and you coffee will not have milk.