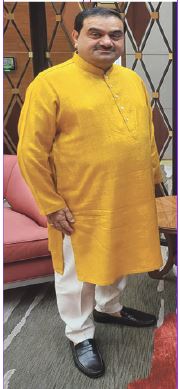

DECLINE: The suit-boot Gautam Adani wearing pyjama-kurta suggesting his current status and dependence on Narendra Modi.

By Sounak Mukhopadhyay

The net worth of the Adani companies fell by 85% toppling down the world’s richest man almost right to the bottom.

Last week, US-based short seller Hindenburg Research accused the Adani group of “brazen” market manipulation and fraud, which caused a significant stock selloff. Gautam Adani has consistently refuted the accusations, and his company has referred to the information as “bogus”. A lot has happened ever since. Here’s a timeline of the events.

January 24-31

Seven listed Adani Group firms have an 85% downside on a fundamental basis due to extremely high valuations, alleged a study from Hindenburg Research on January 24. The report alleged improper use of tax havens and flagged concerns about debt levels.

The following day, entities belonging to the Adani Group experienced a severe stock market correction that reduced their market capitalisation by around Rs1 lakh crore.

Adani Group responded to the Hindenburg Research saying that the report was baseless and termed the allegations “unsubstantiated speculations”. However, Hindenburg emphasised that it stood by its report.

Next, Adani Group said it was not merely an unwarranted attack on any specific company but a calculated attack on India”.Hindenburg said in its reply that, instead of addressing any of the substantive points, Adani “stoked a nationalist narrative’ that seeks to conflate the ‘meteoric rise and the wealth of its chairman, Gautam Adani, with the success of India itself”.

Companies in the Adani Group continued to experience losses as trading resumed, bringing the two-day decline in market capitalisation to Rs4 lakh crore.

While a 1% subscription is seen in the Adani Enterprises FPO on the first day, Abu Dhabi’s International Holding contributed $400 million to the FPO in support of Adani. On January 31, the FPO was fully subscribed.

February 1-6

On February 1, Credit Suisse’s private bank halted margin loans on Adani Bonds. The Swiss lender’s private banking arm assigned a zero lending value for notes sold by Adani Ports and Special Economic Zone, Adani Green Energy, and Adani Electricity Mumbai.

The same day, Adani Group stocks lost $86 billion, forcing the Securities and Exchange Board of India (SEBI) to launch a probe. Later that night, Adani Group called off the Adani Enterprises FPO.

Gautam Adani, once “India’s richest man”, was pushed off the list of the top-10 richest in the world. Mukesh Ambani surpassed his rival and entered the top-10 list.

On February 2, it was revealed that State Bank of India (SBI) had given $2.6 billion to companies in the Adani conglomerate. SBI’s exposure included $200 million from its overseas units, it was reported.

The younger brother of former British Prime Minister Boris Johnson, Lord Jo Johnson, resigned from his position as a non-executive director of UK-based investment company Elara Capital, connected to the now-discontinued Adani Enterprises FPO. Gautam Adani’s three mega projects in Mumbai came under scanner.

On February 3, while maintaining the rating, S&P Global Ratings changed the outlook for Adani Ports and Adani Electricity from stable to negative. Effective from this day, three Adani group companies, including Adani Enterprises, came under short-term additional surveillance measure (ASM) framework of the National Stock Exchange (NSE).

LIC revealed that it held a 4.23% stake in Adani Enterprises while it held a 9.14% stake in Adani Ports and 5.96% in Adani Total Gas.

Finance Minister Nirmala Sitharaman assured investors by calling India a “very well-regulated financial market”. “Investor confidence, which existed before, shall continue even now. Our regulators are normally very-very stringent about governance practices and therefore, one instance, however much talked about globally it may be, is not going to be indicative of how well financial markets are governed,” she said.

Over $110 billion was wiped out from 10 companies, including the flagship Adani Enterprises, related to Adani Group. Finance Secretary TV Somanathan called the fall in Adani Group’s shares a “storm in a teacup” from a macroeconomic perspective.

Due to the company’s current market turmoil, Adani Enterprises decided against trying to raise $122 million (over Rs1,000 crore) through a bond issuance. the company earlier planned to raise money to finance its many initiatives, including the building of a new airport, harbour, power plants and more.

The Congress will launch protests from the Parliament to the streets on February 6. The NSUI-Youth Congress will hold a protest in Delhi in front of the LIC and SBI offices at Parliament Police Station.

Media reports on February 6 suggested that bonds issued by companies in the Adani Group were no longer accepted by Standard Chartered as security for margin lending.

Meanwhile, New York University’s finance professor Aswath Damodaran has valued Adani Enterprises at Rs947 per share.

Courtesy: Livemint