Goa is abuzz with excitement as vintage bike and car owners, users, collectors and fans are decking […]

PROTECT YOUR SMART PHONE

Sep 06- Sep 12, 2025, WEEKEND UPDATES September 5, 2025THERE’S a huge spurge in the theft of smart phones in Goa as in the rest of the country. This is partly because there is a huge and growing demand for second hand phones, particularly of the more expensive brands and categories. In the grey market you may even get high end Apple and Samsung mobiles. The catch is that most of the smart phones in the grey market may be stolen phones. Buyers are therefore advised to check the IMEI number embossed on every mobile phone. If your mobile is stolen and you know your IMEI it can be blocked across all telecom networks. It has been revealed that the police have received over 40,000 complaints of missing phones in the last five years.

AUGMENTED REALITY SURGERY

THE veteran Goan orthopedic surgeon Dr Ameya Velinkar and his team have completed 50 complex joint knee replacement surgeries using a state of the art AR surgical platform. This is an extension of robotic surgery to orthopedics under AR. Under AR real time 3 dimensional views can be seen on the screen, which enables the surgeon to be precise and also prevents blood loss and faster recovery. In neurosurgery it can help in delicate brain operations. The facilities available at the Victor Hospital in Margao and in Ameya Velinkar’s own medical facility.

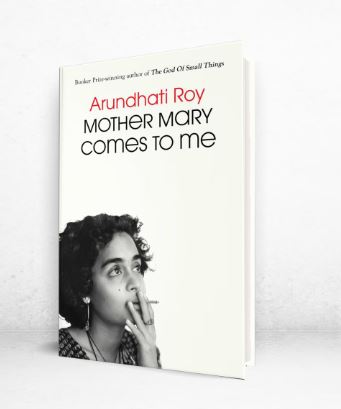

MOTHER MARY COMES HOME

THE controversial author Arundhati Roy had a global launch of her memoirs “Mother Mary Comes Home” at a book release function at Kochi in Kerala . Her new book has nothing to do with the virgin Mary but is an account of her childhood with the focus on her mother Mary Roy.

Mary Roy was one of Kerala’s earliest feminists and won a landmark victory in the Supreme Court to secure equal inheritance rights for Syrian Catholic women, the community she belonged to. This is unique because except in Goa which follows the Uniform Civil Code, the Christian legal system does not confer equal inheritance rights on women in the rest of the country. Arundhati’s mother Mary ran a hands-on residential school in Cochin (old name for Kochi).

Arundhati’s mother was a victim of abuse both from her father and husband. At the launch of her book Arundhati Roy was asked whether she hated her men as much as her mother hated them? Arundhati insisted she loved men and she knew how to manage them. In the light of the fact that Arundhati is not very popular with any government, including the Modi government, the self-styled urban Naxalite warned that attendance of her book release function may not be safe for her fans.

PERSECUTED MIGRANTS MAY STAY

THE Modi government has decided that persecuted migrants from Afghanistan, Bangladesh and Pakistan belonging to the Hindu Sikh Christian and Parsi communities may continue to stay in India without a passport. This is conditional to the fact that they should have entered the country before December 31, 2024. No action will be taken against them under the Foreigners Act which came into force on Monday, September 1, 2025. Significantly, Muslim migrants from Pakistan and Bangladesh are not entitled to this benefit.

GCCI WELCOMES GST REFORMS

THE Goa Chamber of Commerce & Industry president, Pratima Dhond, has welcomed the GST reforms announced recently by Finance Minister Nirmala Sitharaman. The reforms were announced at the 56th GST council meeting. Speaking on the subject GCCI president said the GCCI has consistently pressed for rationalization of GST slabs and simplification of procedures. The present revamp, which introduces a simplified two-slab structure (5% and 18%) with a special 40% slab only for luxury and sin goods, will have a significant positive impact on the Indian economy.

Observes GCCI President Pratima Dhond in a press release, “This across-the-board reform is not only pro-business and pro-consumer but also pro-society. By making insurance and healthcare affordable, while boosting consumption and competitiveness, the GST reforms will go a long way in strengthening India’s economic growth and socio-economic fabric of our nation.”

To sum up the GST Appellate Tribunal review the key benefits to economy and society would be:

- Boost to GDP growth: Rate cuts are expected to add 20-50 basis points to GDP growth, potentially raising the national growth rate by 0.5 percentage points.

- Higher consumption: reduced rates will enhance disposable income and trigger pent-up demand for automobiles, consumer durables, apparel and other aspirational products.

- Competitiveness for MSMEs: Lower compliance costs and reduced tax burden will directly benefit micro, small and medium enterprises.

- Socio-economic gains: The removal of GST on all individual life and health insurance policies – a long-standing public demand – will make insurance affordable, widen coverage, and strengthen the country’s social safety net. This is a landmark step towards financial inclusion and social security.

- Healthcare relief: GST exemption on 33 lifesaving medicines, reduced rates on most other drugs, and cuts on medical equipment and devices will make healthcare more affordable.

- Support to farmers & labour-intensive sectors: Reduction in GST on tractors, agricultural equipment, handicrafts, marble, leather goods and textiles will provide relief to farmers, artisans and workers.

- Common man relief: Daily-use products such as hair oil, soaps, shampoos, toothpaste, bicycles, household items, namkeens, noodles, tea, coffee, milk products, and Indian breads have been brought under the 5% or NIL category, directly benefiting households.

- Simplified tax structure: Rationalizing GST rates can simplify the tax system, reducing complexities and litigation, and making it easier for businesses to comply.

- Increased consumption: Lower GST rates can lead to higher disposable income, resulting in increased consumption, particularly for discretionary items like automobiles, air conditioners and electronics.

- Increased demand: lower GST rates will trigger pent-up demand for aspirational products, including home appliance and apparel.

- Mitigating US tariff impact: The GST rate cut will surely help to cushion the domestic economy from the adverse effects of US tariffs.

- Balanced approach: while the government may face an estimated annual revenue loss of Rs0.7-1.8 trillion due to the reductions, this has been prudently addressed by maintaining a special 40% GSTslab on luxury and sin goods such as pan masala, aerated beverages, and tobacco products.