Goa is abuzz with excitement as vintage bike and car owners, users, collectors and fans are decking […]

BUDGET 2026: DISCIPLINE & DISRUPTION! By Arvind Pinto

BUDGET 2026, Feb 07- Feb 13, 2026 February 6, 2026Arvind Pinto, the chairman of the Citizens Credit Cooperative Bank, reviews Budget 2026 and tells us that in this budget the chasm between the haves and have-nots will only grow sharper…

THE 2026 budget presented by Finance Minister Nirmala Sitharaman on February 1, 2026 is not exactly the bag of goodies that many in the media pundits praised, after the 81-minute budget speech. For a close reading of the figures and fine print, show otherwise. One of the indicators of how good the budget is that the Bombay stock market fell by 1,843 points, representing a decline of 2.23% of its value and a flight of foreign capital. While our traditional newspapers were quick to point out, the stock market is not an accurate indicator of the state of the economy. Sadly, in much of the Indian press, today, there is little critical analysis of the real state of the economy. For our urban press, there is little connect with the reality of rural India.

Let us take the government viewpoint…

ACCORDING to the government, the budget is one which focusses on four major verticals: growth, infrastructure, manufacturing and fiscal discipline. As per governmental data, the Indian economy, the real GDP rate is 7.4%, driven by services, manufacturing and infrastructure investment, coupled with a historically low inflation rate of 1.7%. But in reality, this GDP growth does not automatically guarantee a better standard life for all Indians. Growth in services and manufacturing, while generating job employment in urban areas, has created an inequality in distribution of wealth between those living in urban areas and the majority of our rural countryside.

Further, the migration to urban centres in search of employment, has led to a deterioration of urban services such as transport, housing and medical facilities. Experts were hoping for the revival of the rural sector, job creation in terms of rural infrastructure, which unfortunately has been ignored.

Sadly, the infusion of resources to cities has helped in the growth of slums and a breakdown of urban services, as is seen in the overcrowded cities. Unfortunately, the allocation to the rural sector was a negligible Rs1.63 lakh crore, with a focus on high value crops that could push our exports. Similarly, the allocations for health and rural education in rural areas, the allocations were flat, that raised concerns by economists about the underfunding in social infrastructure. The lack of adequate funding to the rural sector, have a double effect: the increase in the disparity of incomes between Bharat and India; the increase in rural unemployment and the consequent rural degradation. India lives in its villages – we seem to have forgotten.

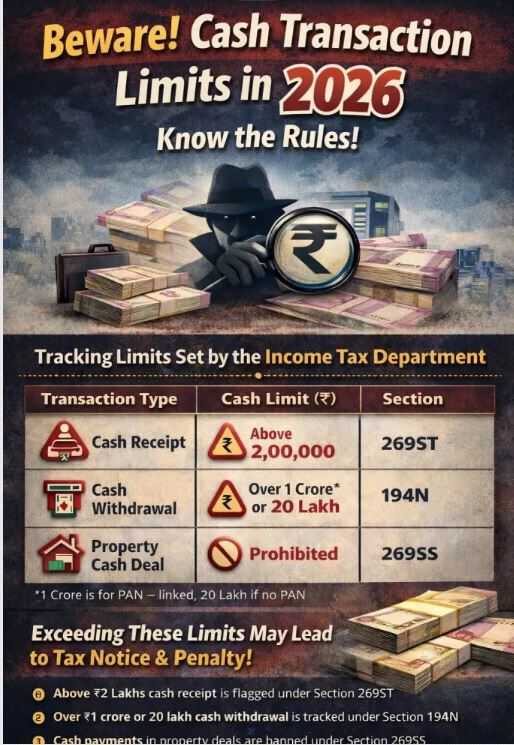

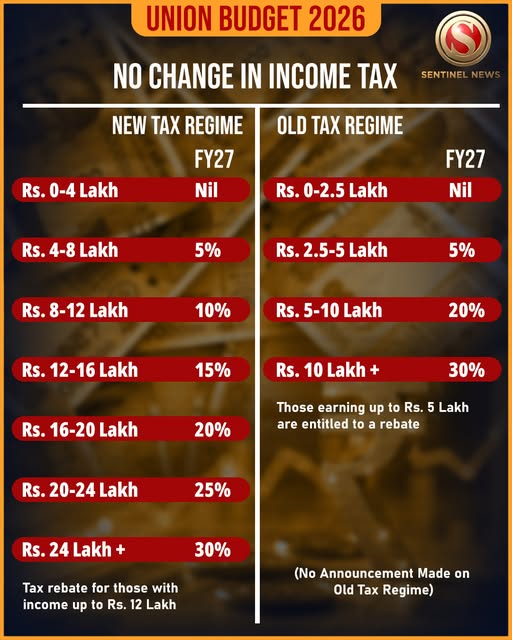

Taxation rather income tax is one of the key factors that the majority of the urban Indians look at during the budget. Unfortunately, there is nothing here for the urban middle class who are now in the tax net. The rates of both income-tax and capital gains remain the same. There was expectation for some reduction in the standard deduction especially for pensioners, but there is nothing for them. Neither is there any increase in the quantum of deductions. This is probably since the government is moving to a system to do away with deductions. Buyback of shares which was earlier taxed in the hands of the company will now be taxed in the hands of the shareholders. Many elderly shareholders who had come to look at these buybacks as income in their old age would not have to pay capital gains on the windfall. There was a hike in the securities transactions tax on derivatives. It was this hike that brought the stock market down on its knees in the red of budget day.

IN the domain of GST, the tax that hit the common man, there is also no relief. The slabs from 5-28% remained the same. The budget rather focuses on compliance and digital monitoring. Minor concessions are given in customs duty mainly to boost exports. Therefore, in the area of taxation, there is no cheer for the common man. While the government holds the view that with moderate inflation there is no hardship for the people, ask any housewife, who goes to the market to see how much does a hundred rupee buy?

The budget had a dampening effect on the rupee. The fall of the markets, with foreign investors selling on budget day had a negative impact on the rupee. There was a market loss of Rs11 lakh crore, leading to capital outflows. On budget day, the rupee slipped to a historic low of Rs92.02 per dollar, with the outflow by foreign investors. This weakening of the rupee will reflect on our international credibility, especially when the country is attempting to project our currency on the world stage. Why would anyone want to hold the rupee, when it keeps falling against the mighty dollar!

One of the urgent needs of India is infrastructure. Over the last few years, there has been a constant push towards the expansion of our roads, railways and urban infrastructure such as metros , bridges, flyovers. The outlay in the budget for FY 2026-27 is Rs 12.2 lakh crore. Roads and highways and railways receive the major portion of this outlay. The focus here is invariable on urban growth, while neglecting the development of our villages . Even after decades of freedom, our villages still lack basic necessities. To give one example, 2,256 villages in Himachal Pradesh alone still lack road connectivity, despite the fact that the PMGSY scheme has launched a scheme to connect all villages in the country.

Or take the case of electricity. While officially India claims that all households have electricity – the definition requires only 10% of households in a village to have electricity. Rural India still lives in a world without the basic amenities of life – Unfortunately this budget will increase this disparity!

Something unusual in the budget

As always there is some unusual eye-catching budget allocations. While the majority of our farmers are semi-literate, engaged in making ends meet, the government has proposed an AI decision making tool to guide crop choices, irrigation, and market time. Yes, this futuristic tool, it would be interesting to see how many farmers will make use of it. For most farmers the important focus is to ensure their crops are protected against the vagaries of nature and that they get a fair renumeration, it is a guess of how would this help them!

In this budget here has been large allocation for semiconductors, robotics, and AI. India with its large population and unemployment does not wish to be left behind in the digital and robotic race. Incidentally, the growth of robotics, would increase our unemployment. To give you an example, why would the traditional household employ a maid to clean, if this can be done by a machine. Or again, washing machines, are slowly making the “dhobi” a dying profession. Or again in most of our urban projects, machines have replaced manual labour. While India would love to follow developed countries by use of robotics and heavy machinery, our people require work and policies designed to curtail employment would be harmful in the long run.

A good feature of the budget was the focus on skill development. There is an allocation of Rs 3,500 crore on skill development and entrepreneurship. This focus is on vocational training and digital skills. India has no several native skills, such as carpet making, brassware, coir industries, Over the decades many of these indigenous handicrafts are falling into disuse, due to the lack of skilled artisans. Rural India needs infusion of assistance for traditional skills which unfortunately was missing in this urban and digital oriented budget. A good initiative was the focus on animal husbandry and fisheries. India has a large animal stock and animal rearing is still in the traditional mode. Hopefully this allocation will help in the increasing use of modern methods of livestock growth. Similarly, the allocation for fisheries is welcome. Goa being on the coast, having many who are dependent on fishing as the occupation, the allocation hopefully will help fisherfolk to modernize their fleet and upgrade their traditional equipment.

Finally, the Union Budget had a significant push for the Cooperative sector. The allocation for the sector increased from Rs 1744 crores from the earlier budget of Rs 1186 crore. The government has formed a Central Ministry of Cooperation, and now looks to strengthen the cooperative movement in the country. A new national Cooperative. A National Council for Cooperative Training in the in process of being formed to strengthen capacity building. Resources are allocated for the digitalization of cooperatives and training. However no direct financial package for cooperative banks unlike the agriculture and fisheries sector.

CHASM GROWS BETWEEN HAVES & HAVE-NOTS

ON a global view, how was the budget viewed? For the common man, the budget hardly evoked a response. Many felt that there was nothing for them. While prices are constant, the budget did not enthuse the public, since it did not impact them. The middle-class has not benefited in terms of reduction of taxes, neither were pensioners enthused. For the Gen X, who would enter into the digital world either to train or work in the sector, the budget has hopes of a better tomorrow. While urban infrastructure would improve, with insufficient resources given to the rural sector, the divide between India and Bharat, which is already a chasm, will expand into a canyon of disparity, between the haves and the have-nots!